The MUFG credit card is a solid option for daily use, travel, and rewards. This guide shows you how to apply online in a few simple steps.

You’ll also learn about the key features and main benefits. Use this to decide if the card fits your needs.

What Is MUFG?

Mitsubishi UFJ Financial Group is one of the biggest financial institutions in Japan. It offers banking, loan, and credit card services. The group was formed after a major bank merger.

It operates both in Japan and globally. MUFG Card Co., Ltd, handles its credit card operations. For more details, visit cr.mufg.jp.

Key Features of MUFG Credit Cards

These cards include practical tools for spending, rewards, and security. Below are the main features you should know.

Various Card Types Available

You can choose from several card types based on your needs:

- Standard Card – Basic features, easy to get

- Gold Card – Better rewards and travel coverage

- Platinum Card – More perks, higher limits

- Student Card – Designed for young adults

- Corporate Card – For business and expense tracking

International Use and Global Acceptance

Cards are accepted worldwide through networks like Visa and Mastercard. You can use them online or in physical stores abroad. Payments can be made in yen or foreign currency.

You’ll also get access to global customer support. Most cards include fraud monitoring for safety. This helps protect your card when used overseas.

Built-in IC Chip for Security

Each card has a secure IC chip to protect your data. The chip creates a unique code for every transaction. This helps block unauthorized access or copying.

Most stores in Japan now require chip cards. It’s also widely accepted overseas. This is now a standard for credit card security.

Point Reward Programs

You can earn points every time you spend. Points may be used for cashback, gifts, or travel miles. Some card types give bonus points for specific spending.

Long-term use can also boost your points. You can check and redeem rewards via cr.mufg.jp or the official app. Always check the rate and expiry.

Mobile App Access for Account Management

Use the MUFG Card app to track your balance, due dates, and spending. You can also enable alerts for transactions.

Cardholders can request limit changes or freeze cards through the app. It’s available for iOS and Android.

Look for “MUFGカード” in your app store. The app supports both English and Japanese.

Benefits of Having a MUFG Credit Card

These cards come with helpful features for daily use, travel, and emergencies. Here’s what you get after approval.

Flexible Repayment Options

You can pick from lump sum, installments, or revolving payments. This helps match your cash flow. You can manage payments via the app or customer support.

Some options include interest fees. Make sure to review the terms. Always pay on time to avoid penalties.

Low or No Annual Fees for Some Cards

Many basic cards offer free use for the first year. Some stay free if you meet certain spending amounts. Premium cards usually have an annual fee, but with more features.

Check the card’s fee table on cr.mufg.jp. Rules may change each year. Always read the latest info before applying.

Special Promotions and Discounts

Cardholders get access to limited-time deals at partner stores. Offers may include cashback, extra points, or discounted prices. You can view deals via the app or email.

Common categories are dining, shopping, and travel. Offers depend on the card type. Always check expiry dates and conditions.

Travel Insurance and Purchase Protection

Some cards include free travel insurance when you book with the card. It covers delays, lost luggage, and certain emergencies.

High-tier cards may also protect purchases. That includes damage or theft within a limited time.

Check the terms on cr.mufg.jp. Know the limits and coverage area.

Emergency Support Services

If you lose your card, use the app to freeze it right away. You can also call the support line for help.

Replacements are sent quickly within Japan. For overseas help, temporary services are offered.

This may include emergency cash or a backup card. Always keep support contacts handy when traveling.

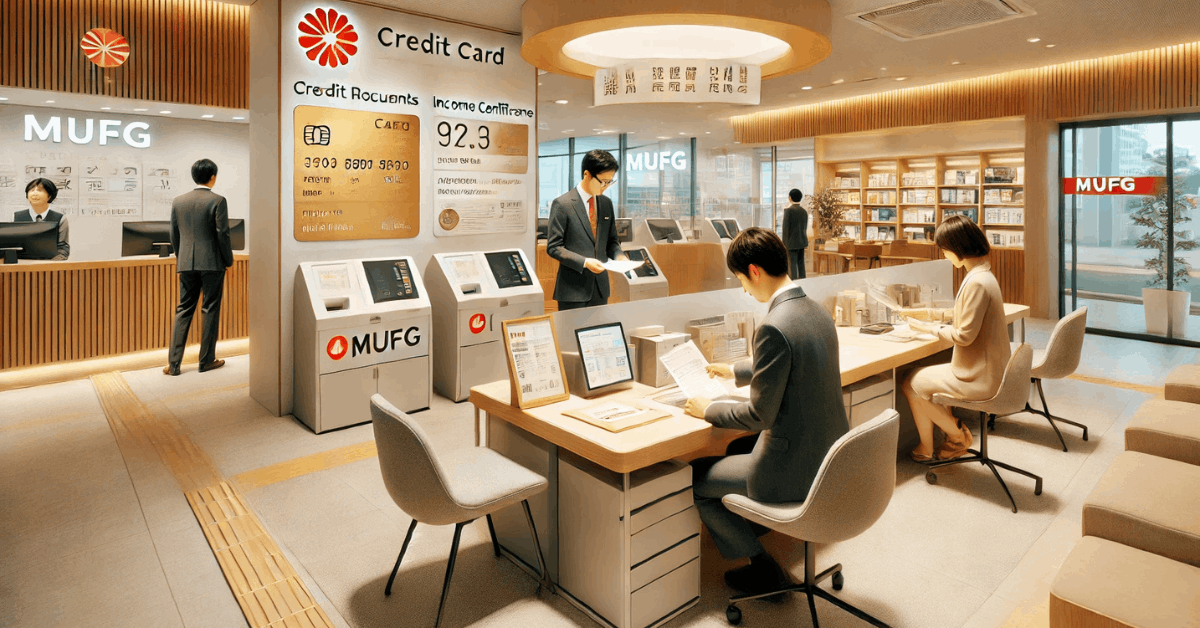

How to Apply Online – Step-By-Step

You can apply quickly using the official site. Just follow these steps and make sure all documents are ready.

- Visit the official MUFG Credit Card website

- Choose the specific card type you want

- Prepare the required documents:

- Residence card or My Number card

- Proof of income or employment

- Japanese address and phone number

- Fill out the online application form

- Review all terms and submit the form

- Wait for confirmation by email or postal mail (takes about 1–2 weeks)

Application Requirements

You must meet these basic conditions before applying. Cards with higher limits may require stricter screening.

- Must be 18 years or older (some cards require 20+)

- Must have a stable source of income

- Must have a Japanese address and an active phone number

- Must not have serious credit issues in Japan

Interest Rates and Fees

These cards come with different rates. Always check the latest terms before applying.

APR – Annual Percentage Rate

Most cards have an APR between 12.25% and 17.95%. This rate applies to unpaid balances.

Your assigned rate depends on the card type and credit review. Always check the updated rate details before you apply.

Cash Advance Rate

If you use your card to withdraw cash, the interest is around 18.0%. This is usually higher than the purchase rate. ATM fees may also apply. Use this option only if necessary.

Late Payment Fee

When you miss a payment, a late fee will be charged. The amount depends on the card and your balance.

It may also impact your credit standing. Set up auto-pay if possible.

Annual Fees

Some cards offer no annual fee for the first year. Others stay free if you meet the minimum spending.

Gold and Platinum cards usually charge a yearly fee. You can find all the fee info on the official site.

Customer Support

For help, contact the official card call center. Dial 0570-050535 (Navi Dial) for general questions.

If you’re outside Japan, call 03-5489-6165. Support is open weekdays from 9:00 to 17:00. Check cr.mufg.jp for full details.

Disclaimer: Rates, terms, and eligibility rules may change without notice. Always verify all details through the official website before applying.

Final Summary: What to Know About This Card?

The MUFG credit card gives you essential tools for daily and international spending. You can apply online by preparing the needed documents and following simple steps.

Knowing the requirements, fees, and interest rates helps you avoid delays. Use this guide to decide if the card matches your needs.