Regular supermarket spending gets more efficient when the card matches weekly routines.

The kasumi credit card aligns tightly with Kasumi and AEON Group stores, turning groceries and household items into WAON POINT earnings, member-only discounts, and immediate mobile payments.

Early planning around “Kasumi Happy Day” and AEON’s broader event calendar helps maximize recurring savings across the month.

Key Benefits And Everyday Value

Payment at Kasumi or AEON-affiliated stores earns WAON POINT, which converts at one point per yen for redemptions, with frequent “point-up” campaigns inside the AEON ecosystem.

Earnings rise on designated store days, and app-driven coupons add incremental value during seasonal pushes. App setup should be done immediately after approval to capture early digital offers and register for notifications.

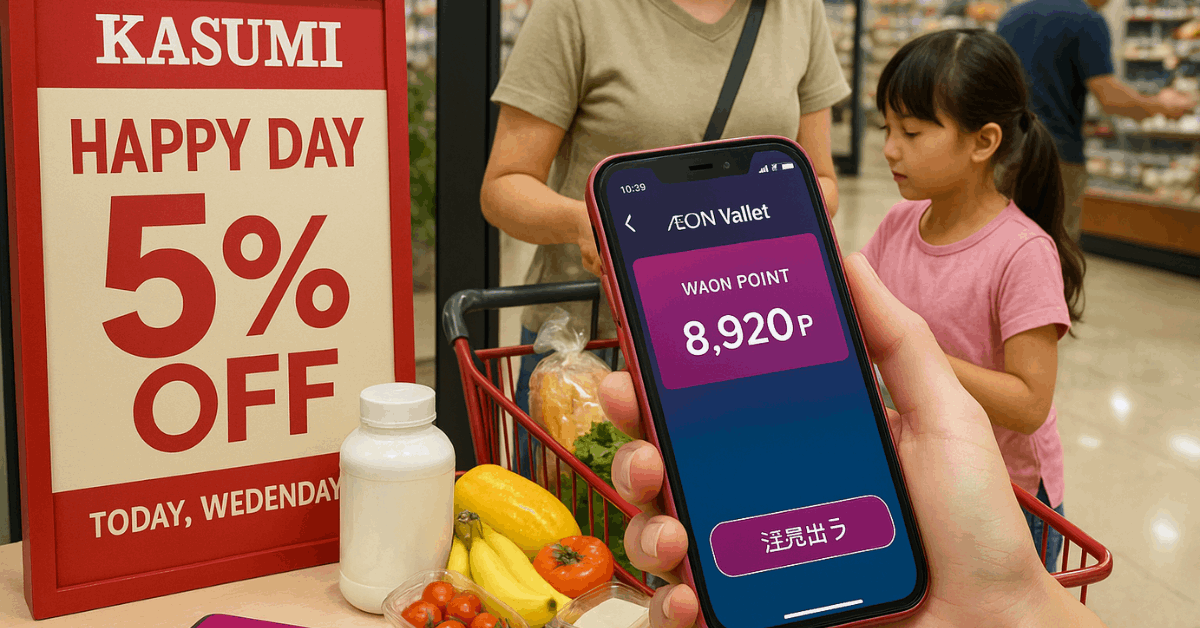

Kasumi Happy Day

Kasumi’s long-running “Kasumi Happy Day” discount applies every Wednesday and Friday at participating Kasumi locations when paying by credit at the register.

Separate from that, AEON Group’s “Customer Appreciation Day” delivers 5% off on the 20th and 30th at group stores, and seniors receive a 5% G.G. discount on the 15th.

These recurring dates form the backbone of predictable savings for weekly and monthly shops.

Use of Digital and Physical Card

Immediate digital use is enabled once approval lands in AEON Wallet, allowing card-not-present and contactless transactions through AEON Pay, iD, and Apple Pay integration where supported devices meet requirements.

Physical plastic arrives later by post, while mobile credentials appear in-app within minutes.

How The Rewards And Discounts Work

At Kasumi stores, credit payment on Wednesdays and Fridays triggers a 5% register discount, subject to product exclusions and payment-method limits.

Purchases on Tuesdays deliver three times the WAON POINT base accrual when paying by credit at Kasumi, stacking with periodic campaigns promoted in the Kasumi app and flyers.

Across AEON Group, double-base WAON POINT accrual is common at participating banners, with broader event days extending benefits to non-Kasumi spending.

Applying Online: Steps, Timing, And Fast Mobile Use

Online application requires a mobile phone number, accurate name entry in kanji where applicable, and setup for online account transfer with a supported financial institution.

Applicants must be at least 18, with special timing rules that affect same-day screening. Submissions between 20:00 and 21:30 may push part of the review to the next day, and any application after 21:30 shifts to next-day screening.

After approval, AEON Wallet issues digital card details for immediate smartphone payments while the physical card is mailed to the registered address.

Rates, Fees, And Cost Controls

Kasumi’s co-branded card follows AEON Credit’s mainstream pricing for revolving balances typical in Japan. Revolving interest sits around the mid-teens annually, late-payment interest can reach statutory ceilings, and cash advances carry higher rates.

Foreign currency purchases attract a conversion margin, and replacement plastic usually incurs a nominal reissue fee.

Spending that is paid in full within the statement grace window avoids interest, keeping grocery savings intact. Always check the latest tariff and disclosure tables inside AEON Wallet and on the issuing site before carrying a balance.

Practical Ways To Maximise Savings

Weekly routines determine real value on retail cards, and Kasumi’s calendar makes optimization simple. Align grocery runs to event days, centralize eligible spend, and route payments through mobile rails to capture extra campaigns. Short, consistent habits compound returns without adding complexity.

- Schedule main grocery trips on Wednesdays or Fridays to capture the “Kasumi Happy Day” 5% register discount.

- Shift fill-in shops to Tuesdays at Kasumi for triple WAON POINT accrual on credit payments.

- Link the account in AEON Wallet and enable AEON Pay for app coupons and point-up campaigns

- Consolidate AEON Group errands on the 20th and 30th for Customer Appreciation Day savings across banners.

- Keep push notifications on for expiry reminders and flash promotions targeting WAON POINT users.

Immediate Digital Use And Wallet Integrations

Approval triggers “immediate issuance” inside AEON Wallet, exposing card details for in-store and online use through AEON Pay, iD, and Apple Pay integration on compatible devices.

Some device families lacking FeliCa may not support iD payments, and merchant acceptance varies by country and terminal. Planning for mobile-first use helps bridge the gap until the plastic arrives.

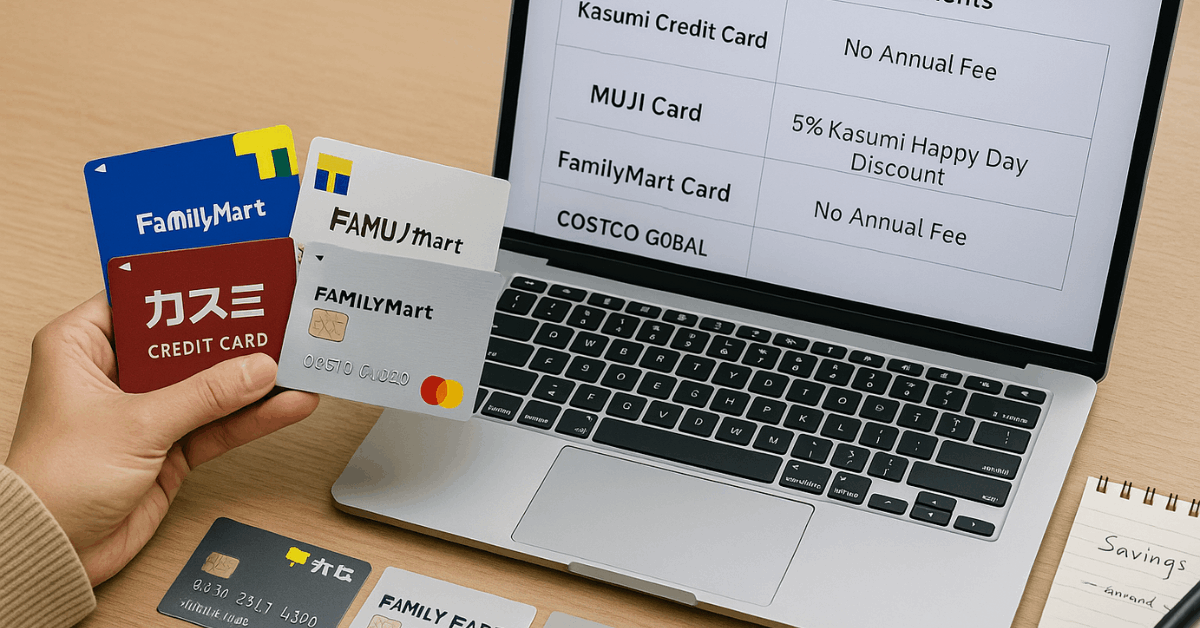

Kasumi Vs Other Everyday Shopping Cards In Japan

Product fit depends on store mix, purchase frequency, and discount cadence. The table aligns headline perks, fees, and usage focus, so recurring shoppers can map benefits to actual baskets.

| Feature | Kasumi Credit Card | MUJI Card (Credit Saison) | FamilyMart T Card (Credit) | Costco Global Card (Orico) |

| Main Use | Groceries and household staples at Kasumi/AEON | Home goods and lifestyle at MUJI | Convenience-store runs within T-POINT ecosystem | Bulk warehouse shopping at Costco |

| Points/Value | WAON POINT; Kasumi Happy Day 5% Wed/Fri; triple points on Tuesdays | MUJI Miles plus Saison Points; periodic MUJI Week perks | T-POINT accumulation; frequent in-app promos | ~1.5% equivalent at Costco Japan; Mastercard global acceptance |

| Fees | No annual fee | No annual fee | No annual fee | No card fee, but Costco membership required |

| Mobile | AEON Wallet, AEON Pay, Apple Pay integration | Mobile app and e-coupons | T-Money and Apple Pay support | Standard mobile wallets via issuer rails |

Sources for Kasumi features and AEON event days are drawn from AEON’s official pages; brand specifics for comparison cards should be verified directly before applying, since campaigns and rates change periodically.

Support And Contact Options

Assistance remains available through AEON Credit Service’s hotline and support counters inside AEON malls.

hoppers near Kasumi locations can also check local service desks for campaign calendars and store-specific exclusions.

Mailing addresses and inquiry forms are published on the issuer and supermarket websites for documentation and status follow-ups.

Responsible Use And Sensible Expectations

Retail cards become powerful when balances are cleared every cycle and spending concentrates on planned store days.

Revolving balances and late-payment charges erode discount gains quickly, so automated payments and monthly reconciliation should be standard.

International travel warrants a quick check on foreign transaction fees and wallet acceptance before relying on the card abroad.

Conclusion

Kasumi’s co-branded card targets habitual supermarket spending with simple rules and reliable dates.

Discounts on Wednesdays and Fridays, triple WAON POINT accrual on Tuesdays, and AEON Wallet issuance on approval create a clean path to monthly savings without an annual fee.

Broad AEON Group events on the 20th and 30th extend value beyond Kasumi aisles, keeping pricing competitive against other store cards when the household budget is disciplined.

Disclaimer

Information reflects publicly available terms at the time of writing and may change without notice.

Eligibility, fees, rates, discounts, and campaign calendars are set by AEON Credit Service, Kasumi, and AEON Group stores; confirm current conditions on official channels before applying or purchasing.

Content is general information, not financial advice, and individual circumstances and local regulations differ. WAON, AEON, Apple Pay, iD, and other marks are trademarks of their respective owners.