The Chase Freedom Credit Card lineup provides broad access to cash back, bonus rewards, and flexible redemption options without charging an annual fee.

For those seeking everyday value with zero complications, these cards offer a strong combination of simplicity, earning potential, and consumer protections.

The family includes Freedom Flex®, Freedom Unlimited®, and Freedom Rise®, each with distinct earning structures suited to different lifestyles.

What Is the Chase Freedom Credit Card?

Chase Freedom cards are no-annual-fee credit cards that earn either flat-rate or category-based cash back.

Cardmembers access Chase Ultimate Rewards®, a proprietary program that lets users redeem points for travel, gift cards, merchandise, or direct cash back. Unlike store credit cards, these cards are widely accepted and come with broader benefits.

Three core variants define the lineup:

- Freedom Unlimited®: Earns 1.5% cash back on all purchases, with higher rates on travel, dining, and drugstores.

- Freedom Flex®: Earns 5% on quarterly rotating bonus categories, plus fixed bonuses on travel, dining, and drugstores.

- Freedom Rise®: Designed for credit newcomers, offering 1.5% on every purchase and growth incentives.

Who Should Consider Chase Freedom Cards

Each Chase Freedom Credit Card serves a different user segment. Freedom Unlimited fits those who want passive rewards on daily expenses without tracking categories.

Freedom Flex appeals to strategic spenders who can optimize rotating bonuses. Freedom Rise supports credit-building with automatic cash back and tools to strengthen credit history.

Cardholders looking for no-annual-fee rewards, travel protections, and access to Chase Ultimate Rewards will find these cards competitive. Frequent online shoppers also benefit from enhanced earnings via Chase’s shopping portal.

Core Benefits and Rewards Structure

Each card in the Chase Freedom family shares baseline protections and rewards, but also offers unique earning mechanics. Choosing the right card depends on spending style and reward preferences.

Shared Features:

- No Annual Fee: All three Chase Freedom cards come with no annual membership fee.

- Rewards That Never Expire: Points remain valid as long as the account stays open.

- Chase Ultimate Rewards Access: Redeem points for travel, cash, gift cards, or purchases through major merchants like Amazon and Apple.

- Purchase Protection: Covers new purchases for 120 days against damage or theft, up to $500 per item.

- Extended Warranty Protection: Adds one year to eligible U.S. manufacturer warranties of three years or less.

- Trip Cancellation Insurance: Coverage of up to $1,500 per person and $6,000 per trip for non-refundable fares canceled due to illness, weather, or other covered events.

Freedom Unlimited®:

- 1.5% cash back on all purchases

- 5% back on travel booked through Chase

- 3% back at drugstores and restaurants

Freedom Flex®:

- 5% on rotating quarterly categories (gas, grocery stores, fitness clubs, and more)

- 5% on Chase travel

- 3% at restaurants and drugstores

- 1% base rate on all other spending

- Cell Phone Protection: Up to $800 per claim when the phone bill is paid with the card

Freedom Rise®:

- 1.5% on every purchase

- No prior credit history required

- Incentives for on-time payments and responsible usage

How to Apply for a Chase Freedom Card

Application requires basic personal and financial information. Eligibility is based on credit profile and income. Follow these steps:

- Choose the card that fits your spending habits and credit goals.

- Visit the official Chase application portal.

- Complete the online form, entering accurate employment and income details.

- Submit identification and agree to a credit pull.

- Await instant approval or follow up with additional documentation if requested.

- Approval generally requires fair to good credit, though Freedom Rise accommodates those new to credit.

Bonus Categories and Manual Activation

Chase Freedom Flex offers quarterly rotating categories with 5% cash back. Common categories include:

- Grocery stores

- Gas stations

- Movie theaters

- Fitness clubs

- Restaurants

Activation is required each quarter. Log in to your Chase online account or app to confirm activation. Missing the activation window may result in default 1% earnings on those purchases.

Using the Chase Shopping Portal

The Shop Through Chase portal allows members to earn bonus rewards when shopping with partner retailers.

Access it via your online account, browse eligible merchants, and click through to make a qualifying purchase. These transactions may stack with category bonuses.

Examples include:

- Department stores

- Electronics retailers

- Travel sites

- Deals vary, so checking the portal before major purchases helps maximize points.

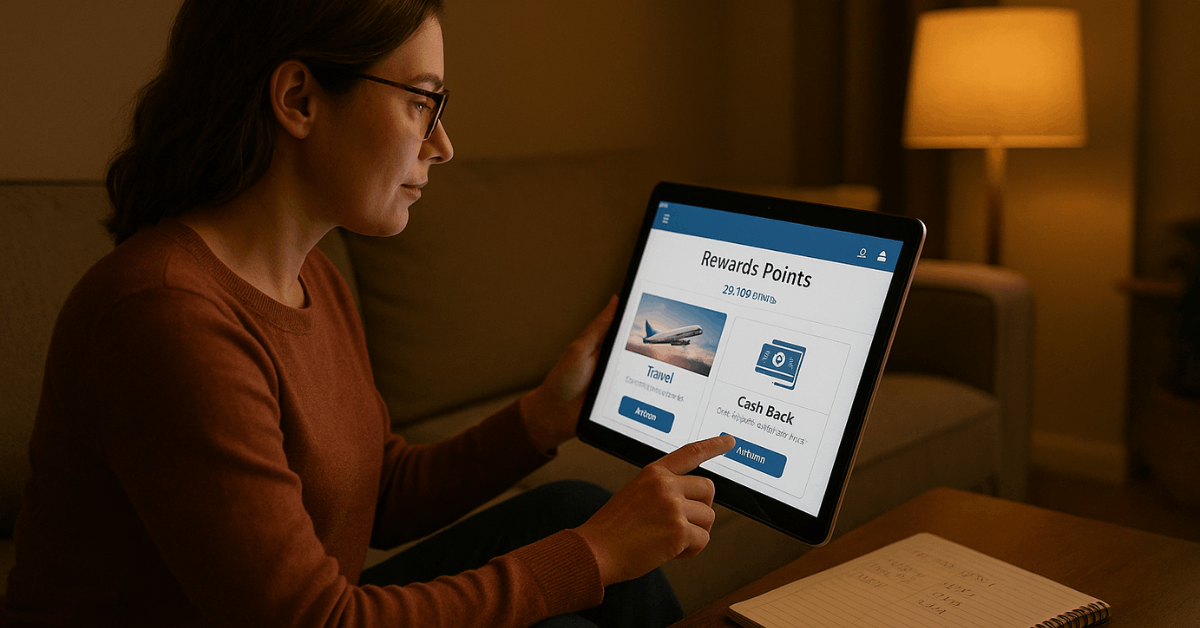

Redeeming Chase Ultimate Rewards Points

Chase Ultimate Rewards provides flexible redemption options that suit multiple financial goals.

- Cash Back: Convert points to statement credits or direct deposits.

- Gift Cards: Choose from over 175 brands.

- Travel: Book through the Chase travel portal with no blackout dates.

- Retail Purchases: Use points on Amazon or Apple transactions.

- PayPal Checkout: Points may be used when checking out with PayPal at supported merchants.

No minimum redemption applies. Pooling points from multiple Chase cards can unlock higher redemption rates when transferred to premium travel cards.

Transferring Points to Travel Partners

Select Chase cards enable point transfers to leading hotel and airline loyalty programs. Transfer ratio is typically 1:1. This option suits cardholders aiming for premium travel redemptions.

Eligible partners include:

- World of Hyatt

- Marriott Bonvoy

- United MileagePlus

- British Airways Executive Club

Compare the value of transferred points against direct Chase bookings to find the better deal. Transfers are generally instant but can take up to a few days.

Consumer Protections and Travel Benefits

Beyond rewards, the Chase Freedom Credit Card lineup includes strong consumer protections.

- Auto Rental Collision Damage Waiver: Secondary coverage for theft or damage in the U.S.

- Travel and Emergency Assistance Services: Provides legal, medical, and emergency referrals while traveling.

- Cell Phone Protection (Flex only): Up to two claims annually, $800 max per claim, $50 deductible.

Coverage details vary. Consult your card’s Guide to Benefits for full eligibility and exclusions.

Common Mistakes to Avoid

Failing to activate quarterly bonuses on time is a missed opportunity. Avoid using the wrong card for bonus categories.

Not using the shopping portal also leaves rewards on the table. Always check redemption value before converting points, especially when booking travel.

Late payments may result in forfeited rewards and penalty APRs. Set alerts or auto-pay to stay current.

Conclusion

The Chase Freedom Credit Card family covers a wide range of spending habits and credit profiles.

From strategic bonus earners to credit novices, there’s a fit for most users. Pairing the right card with your spending and using tools like the Chase shopping portal or Ultimate Rewards transfers can boost long-term value.